Complete Pakistan Tax Guide 2025-26: FBR-Approved Tax Rates, Slabs & Calculator

Last Updated: July 23, 2025 | Tax Year: 2025-26 (July 2025 - June 2026) | Author: Tax Expert Team | Reviewed by: Certified Public AccountantRates verified against FBR Budget 2025-26 official documentation

Table of Contents

- Understanding Pakistan's Tax Year System

- Complete Tax Slab Breakdown 2025-26

- Step-by-Step Tax Calculation Examples

- FBR-Approved Tax Calculator Guide

- Provincial and Sector-Specific Considerations

- Tax Planning Strategies for 2025-26

- Filing Requirements and Deadlines

- Comprehensive FAQ Section

- What's New in 2025-26

Pakistan's tax system has undergone significant refinements for the 2025-26 tax year, with the Federal Board of Revenue (FBR) maintaining a progressive structure while adjusting rates to reflect current economic conditions. Whether you're a salaried professional, business owner, or tax consultant, this comprehensive guide provides everything you need to navigate Pakistan's current tax landscape effectively.

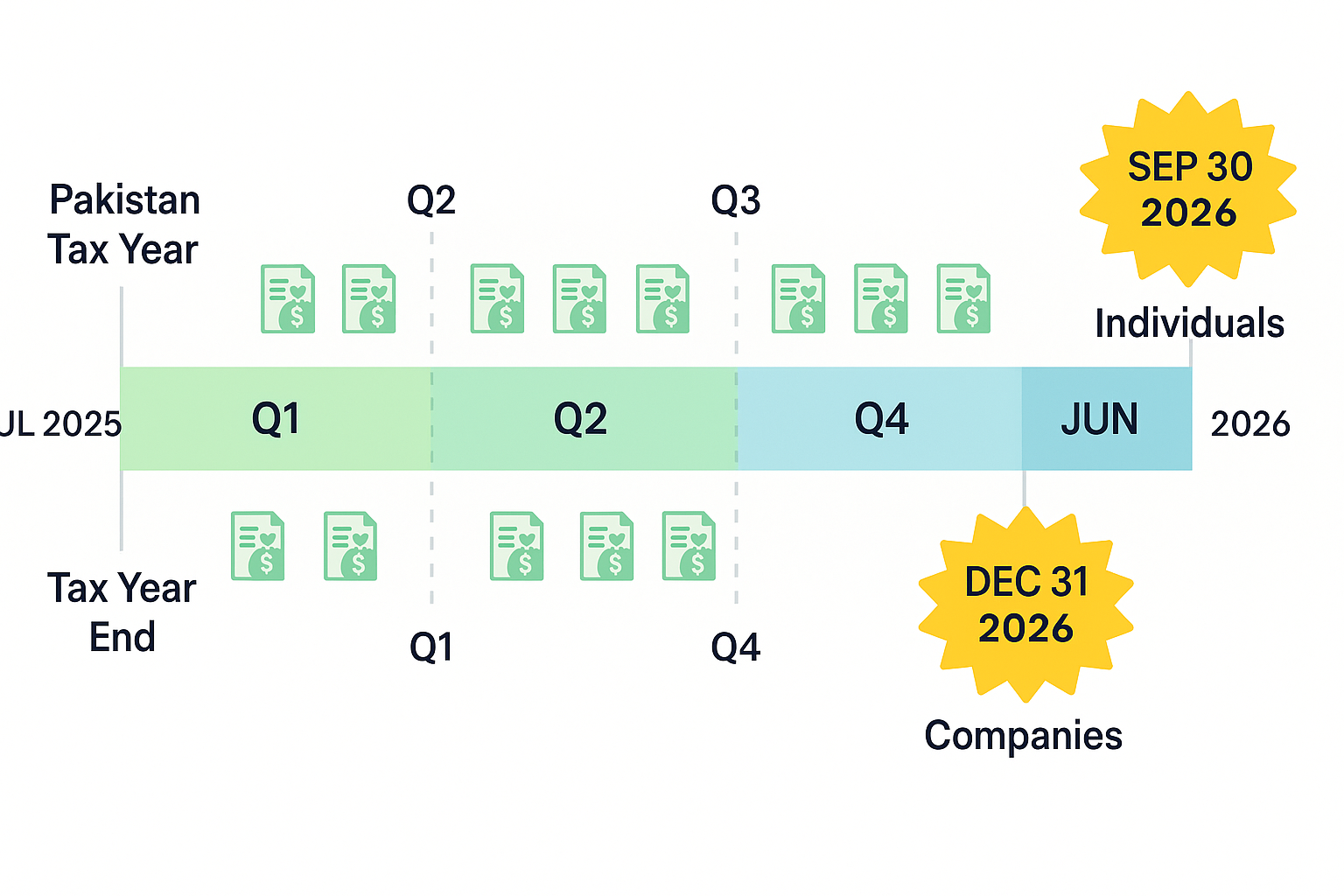

Understanding Pakistan's Tax Year System

IMPORTANT: Pakistan's tax year runs from July 1st to June 30th, unlike many countries that follow a calendar year. The current tax year 2025-26 started on July 1, 2025, and will end on June 30, 2026.

This means:

- Income earned from July 1, 2025, to June 30, 2026, falls under tax year 2025-26

- Tax returns for 2025-26 will be filed in 2026

- Monthly salary deductions throughout this period use the 2025-26 tax slabs

Complete Tax Slab Breakdown 2025-26

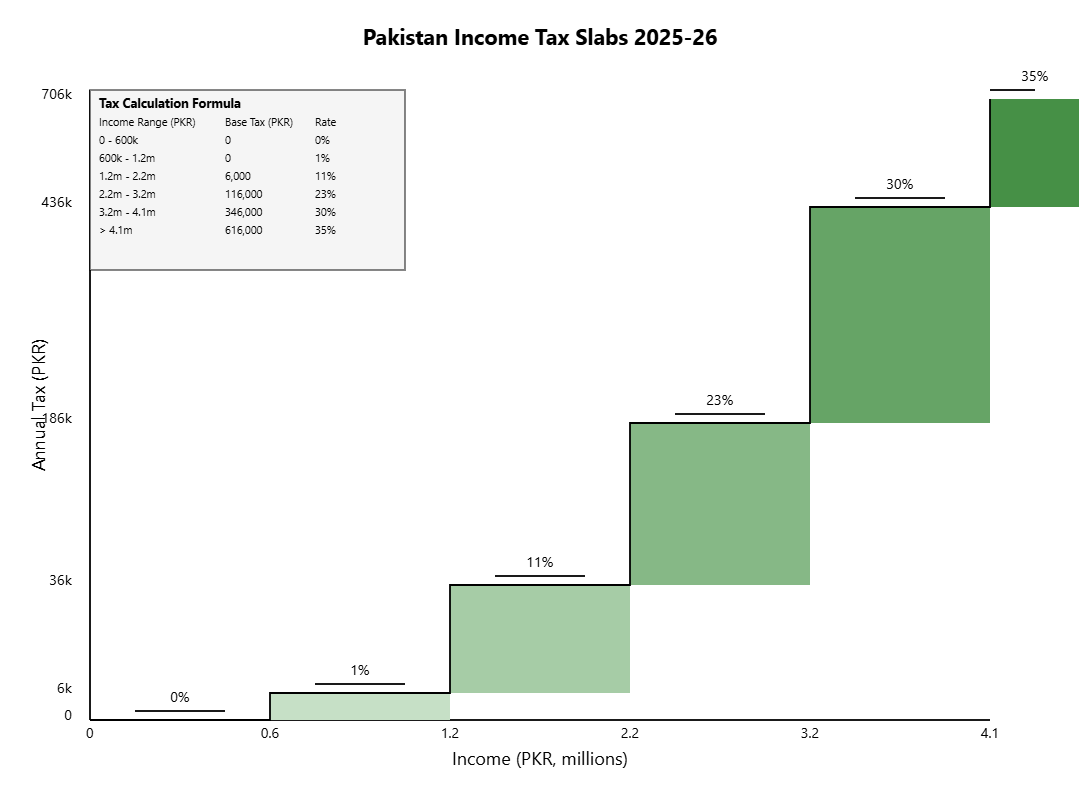

The FBR has maintained six distinct tax brackets for the 2025-26 tax year. Here's the complete breakdown with detailed explanations:

Tax Slab 1: Income up to Rs. 600,000

- Tax Rate: 0%

- Annual Tax Liability: Rs. 0

- Who This Affects: Entry-level employees, minimum wage workers, part-time professionals

- Key Benefit: Complete tax exemption ensures basic earners retain full income

Tax Slab 2: Income from Rs. 600,001 to Rs. 1,200,000

- Tax Rate: 1% on income exceeding Rs. 600,000

- Maximum Annual Tax: Rs. 6,000

- Calculation: (Income - 600,000) × 1%

- Target Group: Junior professionals, skilled workers, government employees (BPS 11-14)

Tax Slab 3: Income from Rs. 1,200,001 to Rs. 2,200,000

- Tax Rate: 15% on income exceeding Rs. 1,200,000

- Base Tax: Rs. 6,000 (from previous slab)

- Calculation: Rs. 6,000 + (Income - 1,200,000) × 15%

- Target Group: Mid-level professionals, government officers (BPS 15-17)

Tax Slab 4: Income from Rs. 2,200,001 to Rs. 3,200,000

- Tax Rate: 25% on income exceeding Rs. 2,200,000

- Base Tax: Rs. 156,000 (Rs. 6,000 + Rs. 150,000)

- Calculation: Rs. 156,000 + (Income - 2,200,000) × 25%

- Target Group: Senior professionals, department heads, experienced consultants

Tax Slab 5: Income from Rs. 3,200,001 to Rs. 4,100,000

- Tax Rate: 30% on income exceeding Rs. 3,200,000

- Base Tax: Rs. 406,000

- Calculation: Rs. 406,000 + (Income - 3,200,000) × 30%

- Target Group: Senior management, specialized professionals, business owners

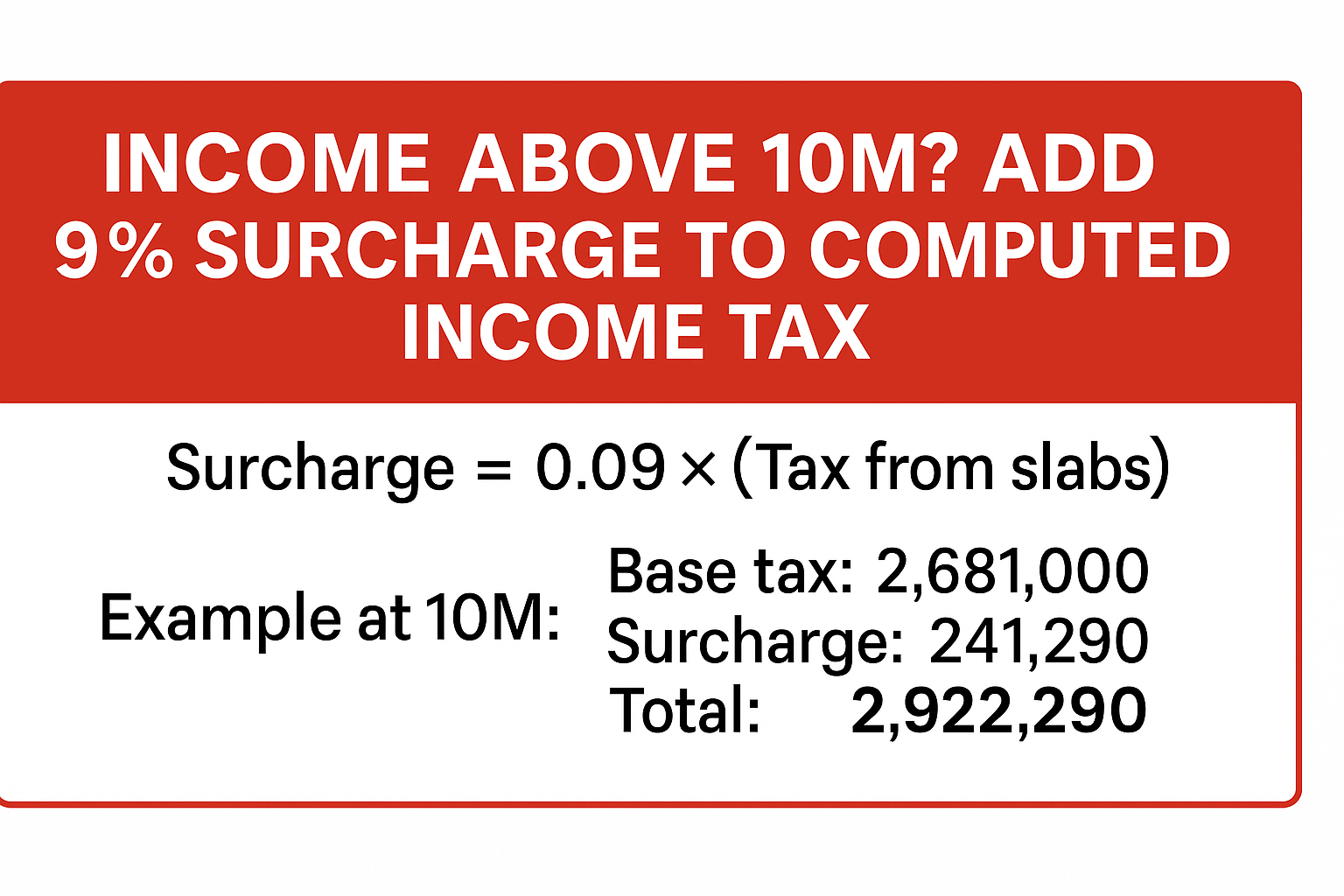

Tax Slab 6: Income exceeding Rs. 4,100,000

- Tax Rate: 35% on income exceeding Rs. 4,100,000

- Base Tax: Rs. 676,000

- Calculation: Rs. 676,000 + (Income - 4,100,000) × 35%

- Target Group: Top executives, high-earning professionals, business leaders

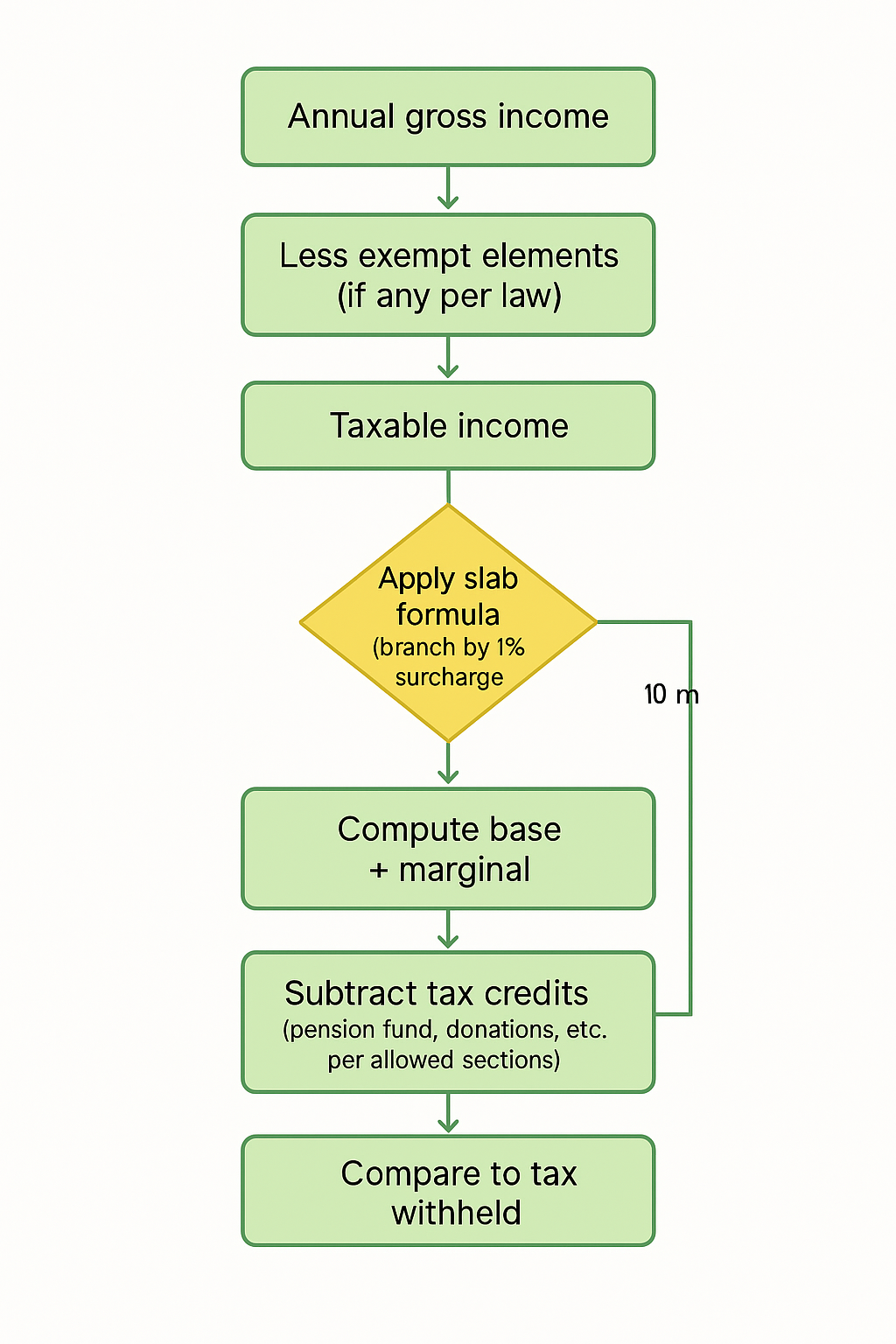

Step-by-Step Tax Calculation Examples

Understanding how progressive taxation works is crucial. Here are detailed examples across different income levels:

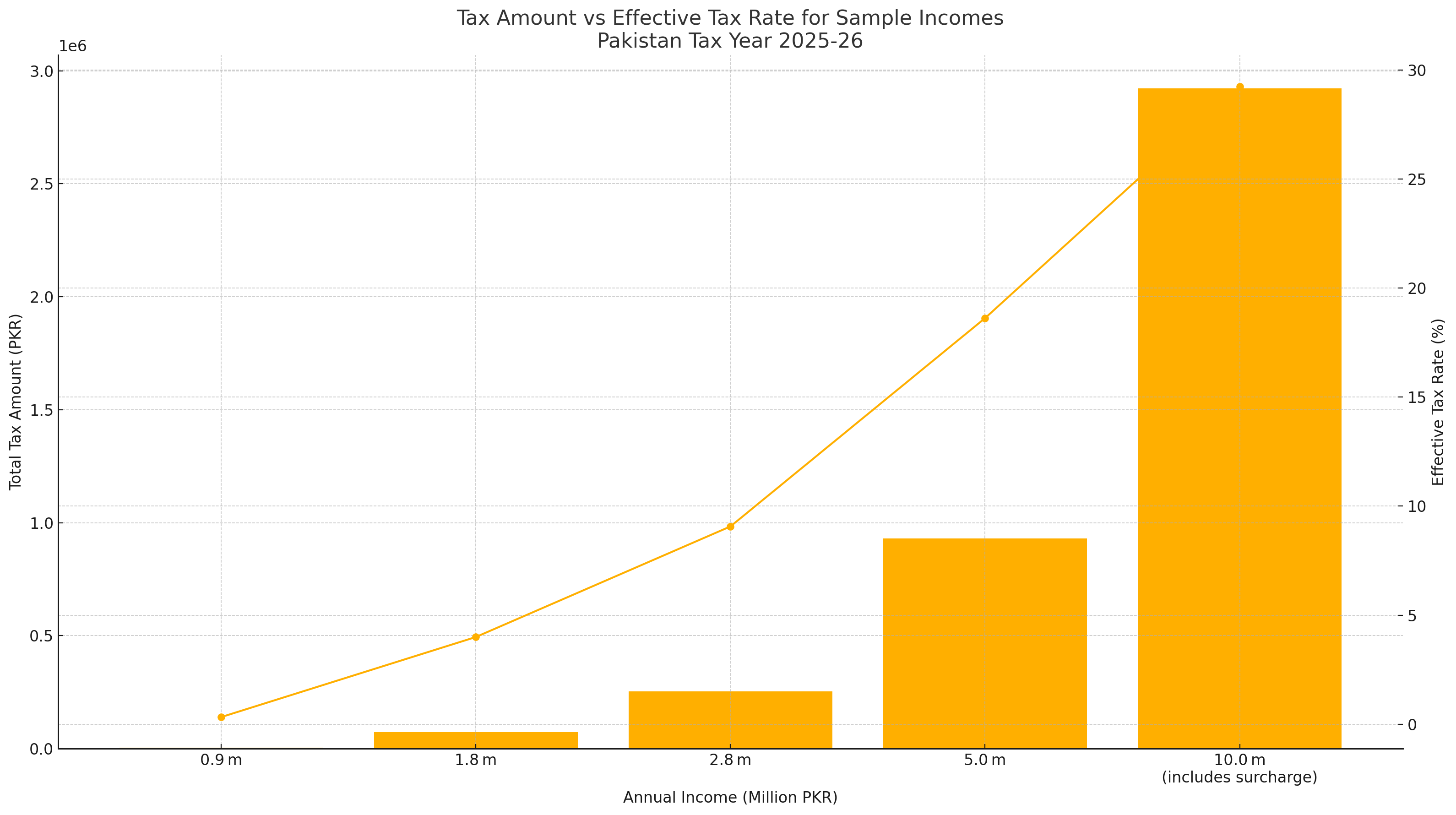

Example 1: Junior Professional - Rs. 900,000 Annual Income

Step 1: First Rs. 600,000 = Rs. 0 tax (0% rate)Step 2: Remaining Rs. 300,000 = Rs. 3,000 tax (1% rate)Total Annual Tax: Rs. 3,000Effective Tax Rate: 0.33%Monthly Deduction: Rs. 250

Example 2: Mid-Level Manager - Rs. 1,800,000 Annual Income

Step 1: First Rs. 600,000 = Rs. 0 tax (0% rate)Step 2: Next Rs. 600,000 = Rs. 6,000 tax (1% rate)Step 3: Remaining Rs. 600,000 = Rs. 90,000 tax (15% rate)Total Annual Tax: Rs. 96,000Effective Tax Rate: 5.33%Monthly Deduction: Rs. 8,000

Example 3: Senior Professional - Rs. 2,800,000 Annual Income

Step 1: First Rs. 600,000 = Rs. 0 taxStep 2: Next Rs. 600,000 = Rs. 6,000 taxStep 3: Next Rs. 1,000,000 = Rs. 150,000 taxStep 4: Remaining Rs. 600,000 = Rs. 150,000 tax (25% rate)Total Annual Tax: Rs. 306,000Effective Tax Rate: 10.93%Monthly Deduction: Rs. 25,500

Example 4: Executive - Rs. 5,000,000 Annual Income

Step 1: First Rs. 600,000 = Rs. 0 taxStep 2: Next Rs. 600,000 = Rs. 6,000 taxStep 3: Next Rs. 1,000,000 = Rs. 150,000 taxStep 4: Next Rs. 1,000,000 = Rs. 250,000 taxStep 5: Next Rs. 900,000 = Rs. 270,000 tax (30% rate)Step 6: Remaining Rs. 900,000 = Rs. 315,000 tax (35% rate)Total Annual Tax: Rs. 991,000Effective Tax Rate: 19.82%Monthly Deduction: Rs. 82,583

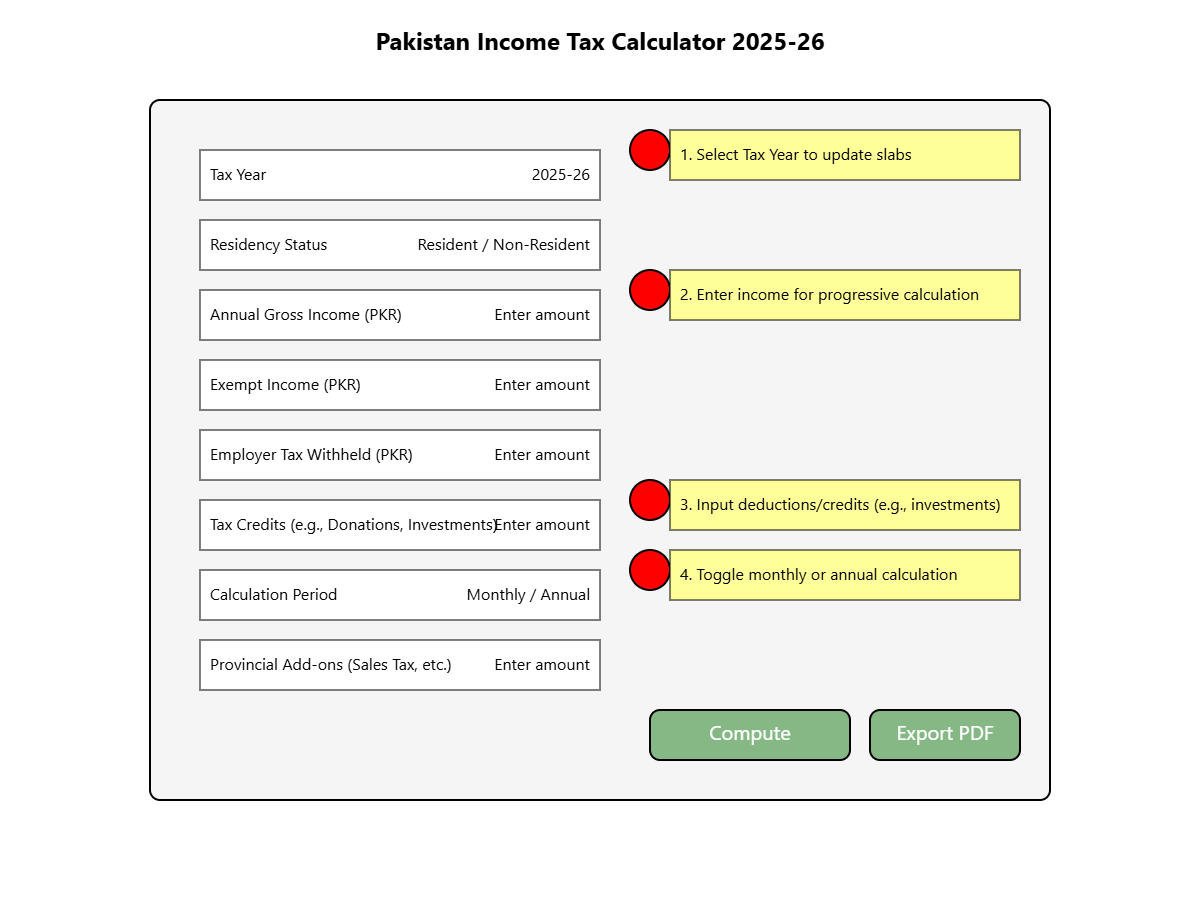

FBR-Approved Tax Calculator Guide

When selecting a tax calculator, ensure it meets these FBR compliance standards:

Essential Features for Accurate Calculation:

- Updated 2025-26 tax slabs

- Progressive tax calculation methodology

- Deduction incorporation (provident fund, insurance, etc.)

- Monthly vs. annual breakdown options

- Provincial tax considerations

Recommended Official Resources:

- FBR Official Portal: https://www.fbr.gov.pk

- FBR E-Filing System: https://e.fbr.gov.pk

- IRIS (Integrated Revenue Information System): Official FBR tax calculation tool

Third-Party Verified Tools:

- TaxWizard Pakistan Calculator: https://taxwizard.pk/#calculator

- Always cross-verify results with official FBR tools

Provincial and Sector-Specific Considerations

Provincial Tax Variations

While federal income tax rates apply nationwide, consider these additional factors:

Sindh Province: Additional provincial taxes on certain servicesPunjab Province: Specific professional tax rates for certain occupationsKhyber Pakhtunkhwa: Regional development taxes in certain areasBalochistan: Mining sector-specific tax implications

Sector-Specific Deductions and Rates:

Information Technology Sector

- Special tax rates for IT exports

- Software development incentives

- Freelancer vs. company employee distinctions

Textile Industry

- Export-oriented unit benefits

- Special economic zone considerations

Banking and Finance

- Additional regulatory compliance requirements

- Bonus taxation specifics

Government Employees

- Special allowance exemptions

- Pension contribution benefits

Tax Planning Strategies for 2025-26

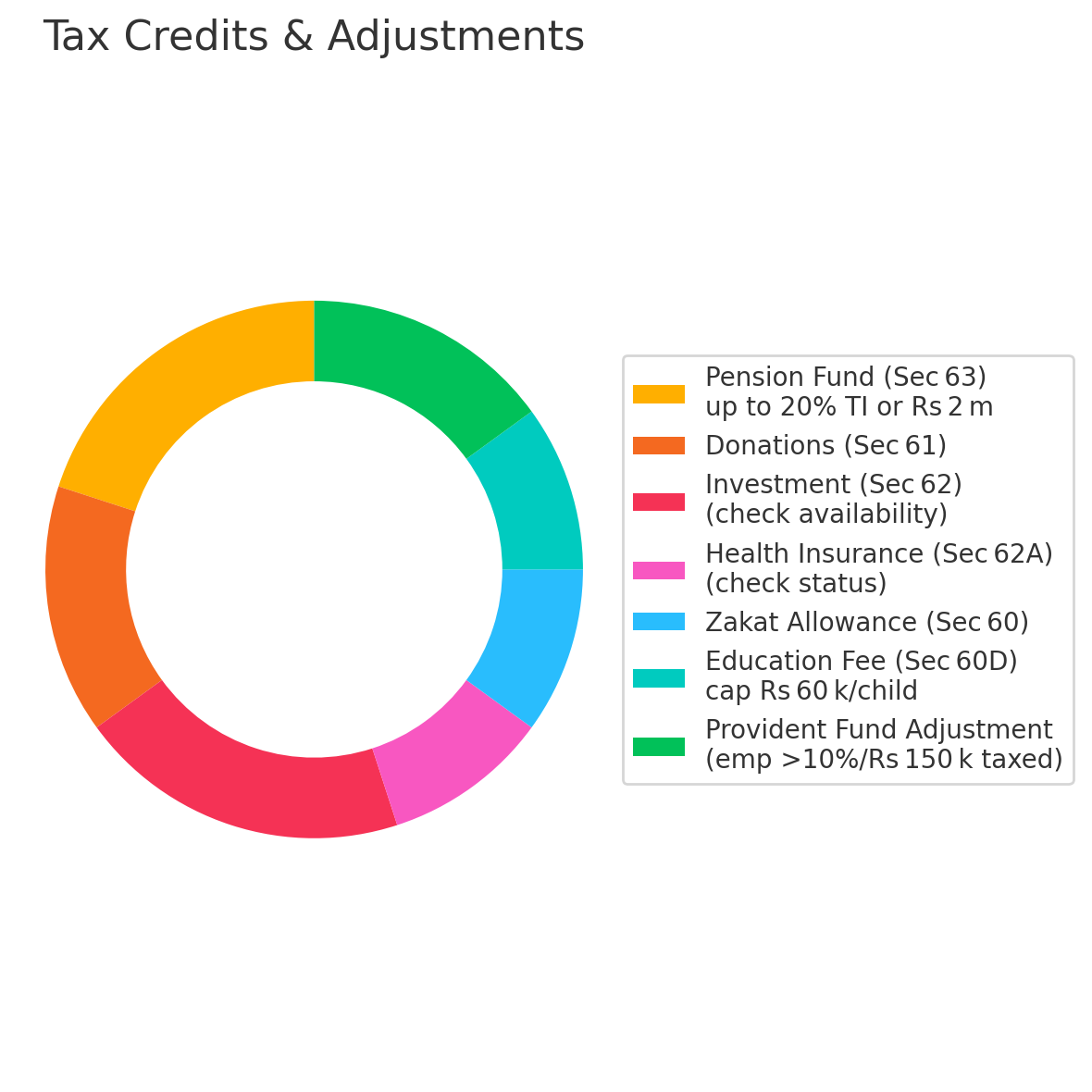

Maximize Legal Deductions

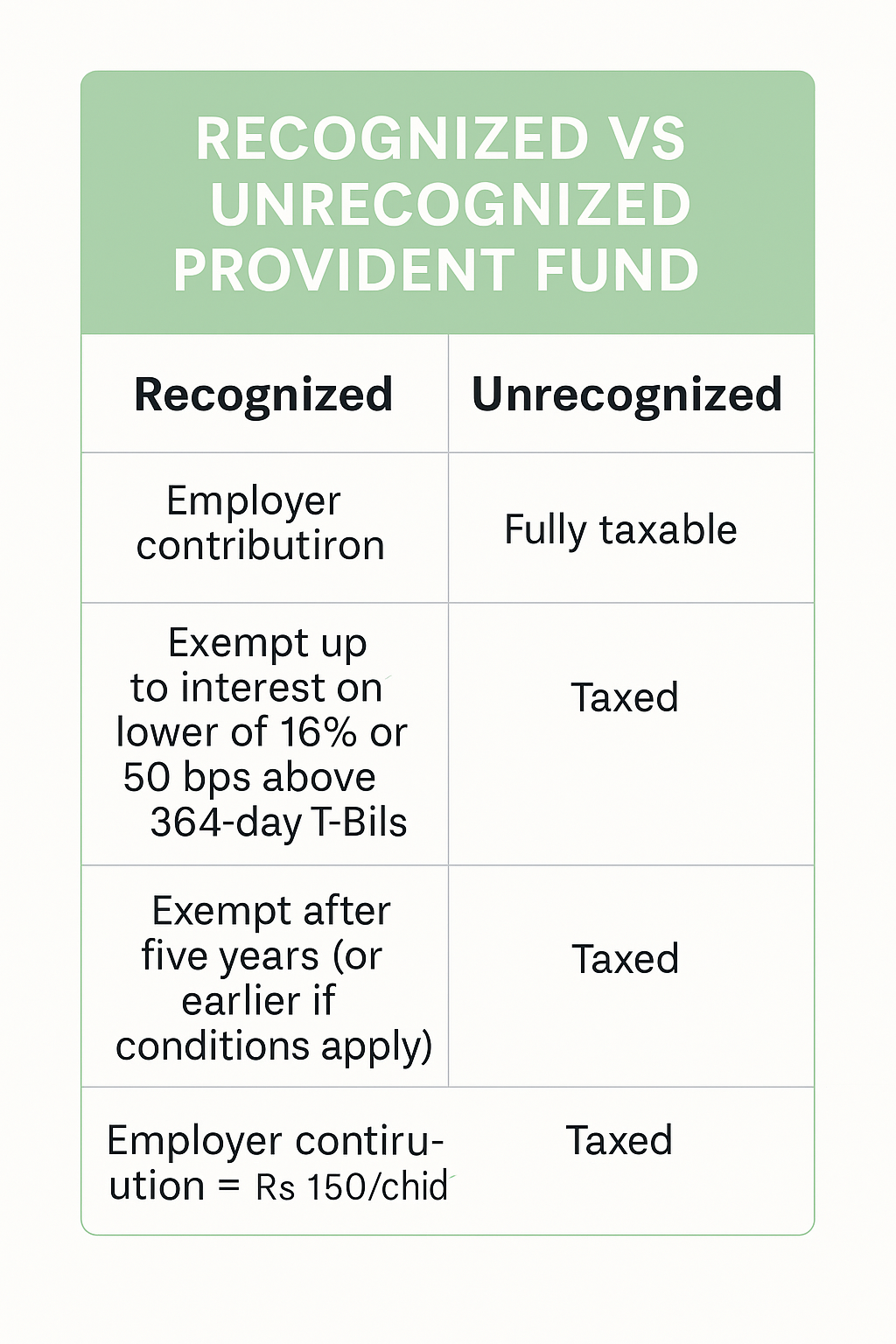

1. Provident Fund Contributions

- Maximum Deduction: 25% of salary or Rs. 150,000 annually

- Strategy: Maximize employer matching contributions

- Impact: Can reduce taxable income significantly for higher earners

2. Life Insurance Premiums

- Maximum Deduction: Rs. 100,000 annually

- Strategy: Choose policies that qualify for tax benefits

- Tip: Ensure policy meets FBR criteria for deduction eligibility

3. Medical Insurance

- Maximum Deduction: Rs. 100,000 for self and family

- Strategy: Include parents in family coverage for additional benefits

- New for 2025-26: Increased coverage for critical illness insurance

4. Educational Expenses

- Maximum Deduction: Varies by education level

- Strategy: Plan timing of fee payments within tax year

- Coverage: Children's education, professional development courses

5. Investment in Approved Schemes

- National Savings Certificates: Up to Rs. 500,000 deduction

- Mutual Funds: Specific approved funds qualify

- Real Estate: First-time home buyer benefits

Strategic Income Timing

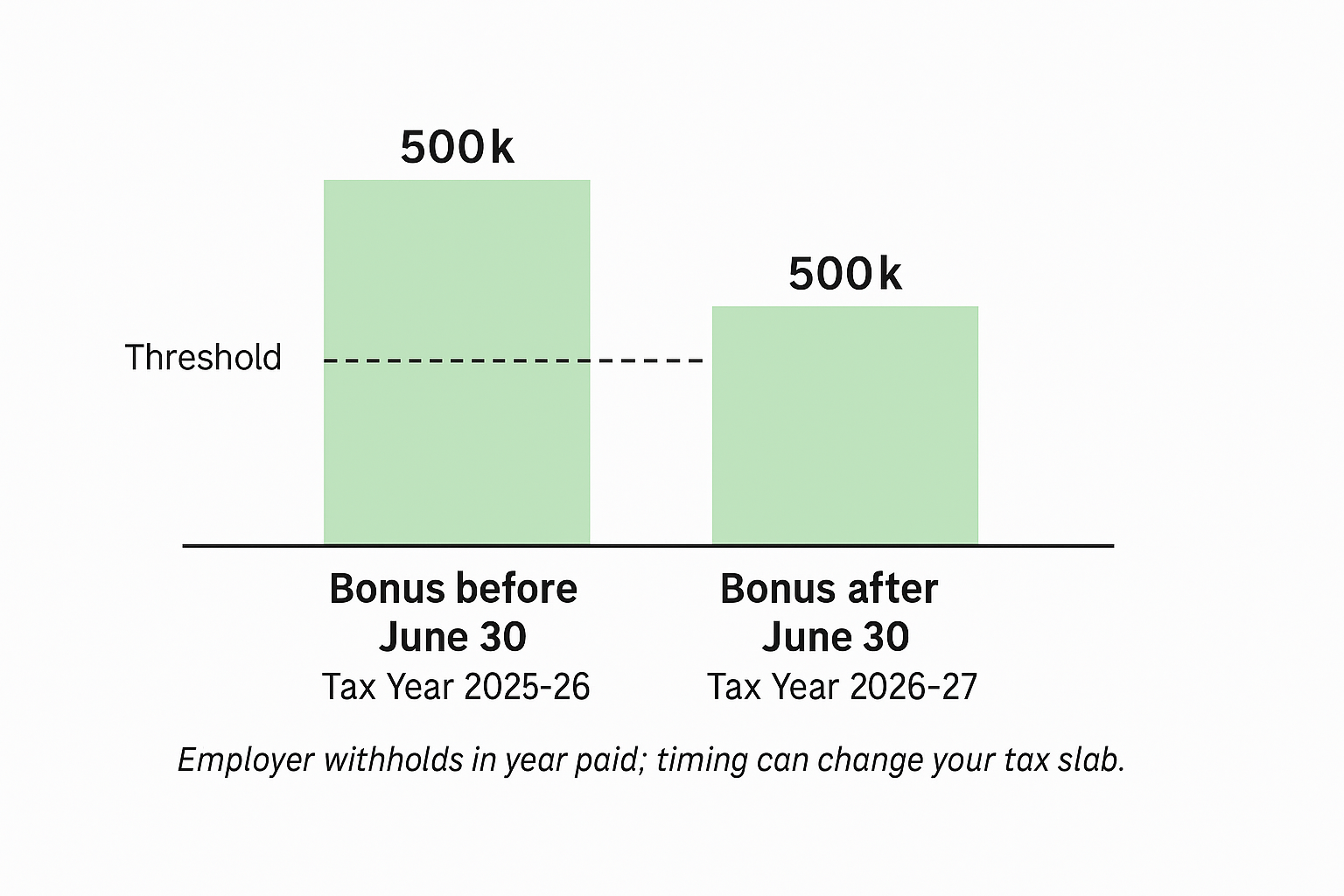

- Bonus Planning: Consider tax year timing for bonus payments

- Overtime Management: Spread overtime across tax years if possible

- Investment Income: Time capital gains realization strategically

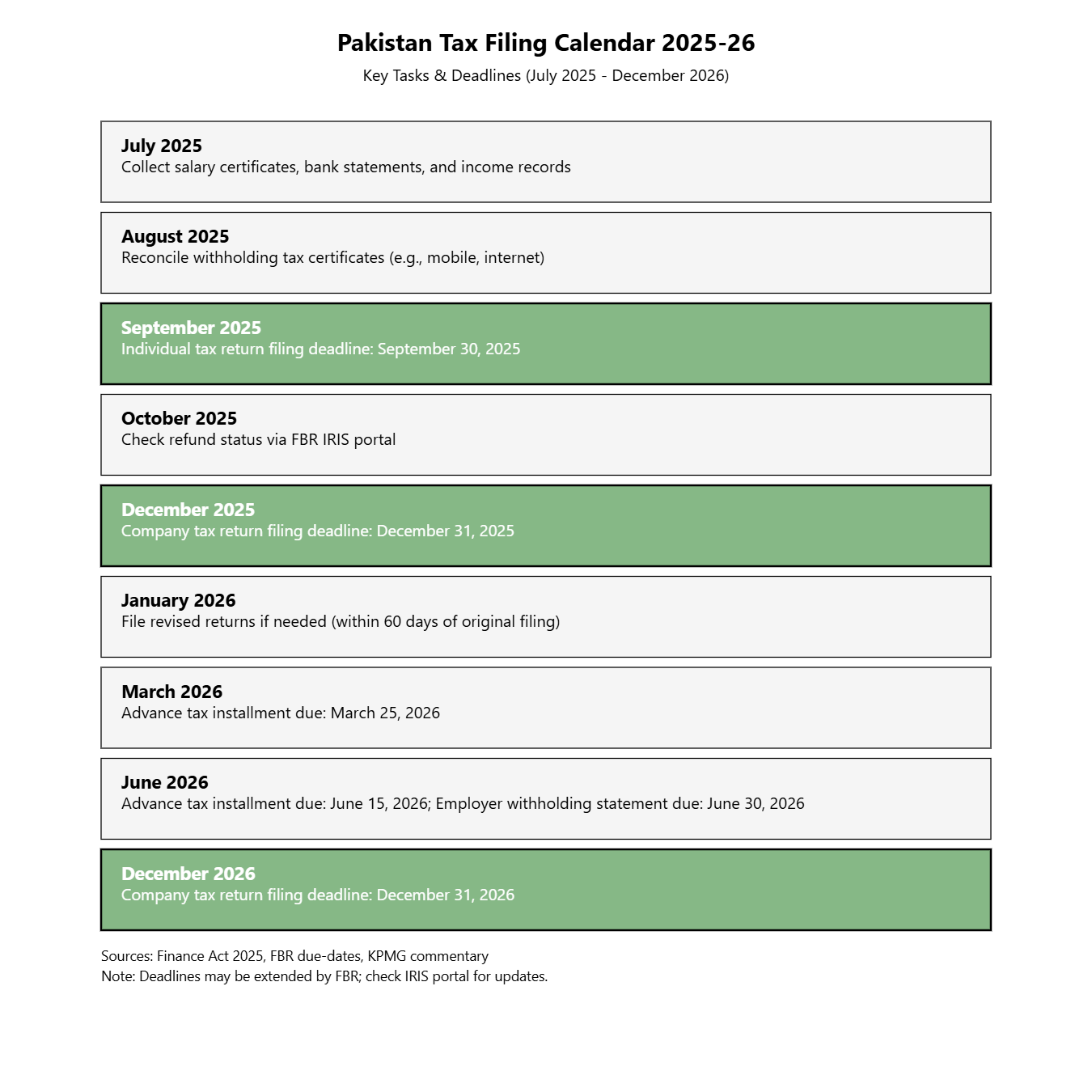

Filing Requirements and Deadlines

Who Must File Returns?

- Salaried individuals earning above Rs. 600,000 annually

- Business owners regardless of income level

- Property owners above certain thresholds

- Foreign income recipients

Key Dates for 2025-26:

- Tax Year Start: July 1, 2025

- Tax Year End: June 30, 2026

- Return Filing Deadline: September 30, 2026 (for individuals)

- Corporate Return Deadline: December 31, 2026

Required Documentation:

- Salary certificates from all employers

- Bank statements

- Investment proofs

- Property ownership documents

- Medical and insurance receipts

What's New in 2025-26

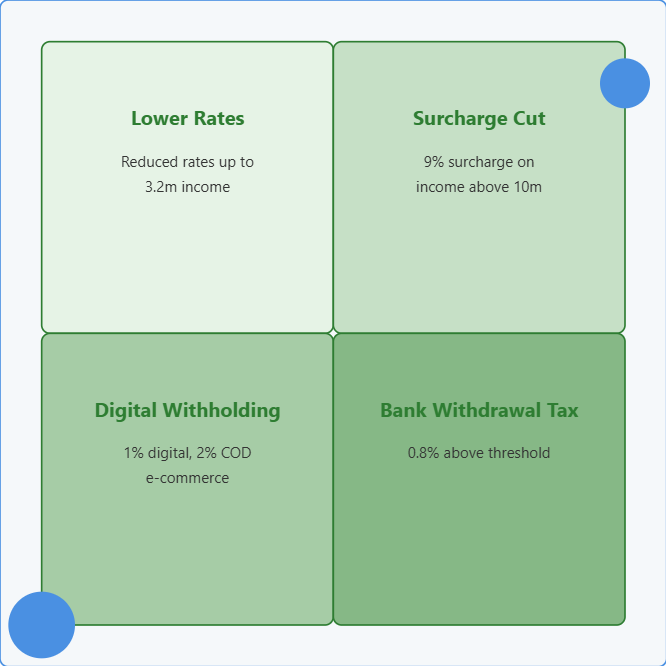

Recent Changes from Previous Year:

- Slab Adjustments: Minor modifications to middle-income brackets

- Digital Integration: Enhanced e-filing system capabilities

- Deduction Updates: Increased limits for certain categories

- Compliance Measures: Stricter enforcement for high-income earners

Upcoming Changes to Watch:

- Potential mid-year adjustments based on economic conditions

- Digital payment incentives under consideration

- Simplified filing procedures for small businesses

Comprehensive FAQ Section

General Tax Questions

Q1: How do I know which tax bracket I fall into? Calculate your total annual taxable income and compare it against the slab thresholds. Remember, progressive taxation means you pay different rates on different portions of your income.

Q2: Can I change my tax bracket through deductions? Yes, legitimate deductions can reduce your taxable income and potentially move you to a lower bracket, though you'll only save the difference in rates on the reduced amount.

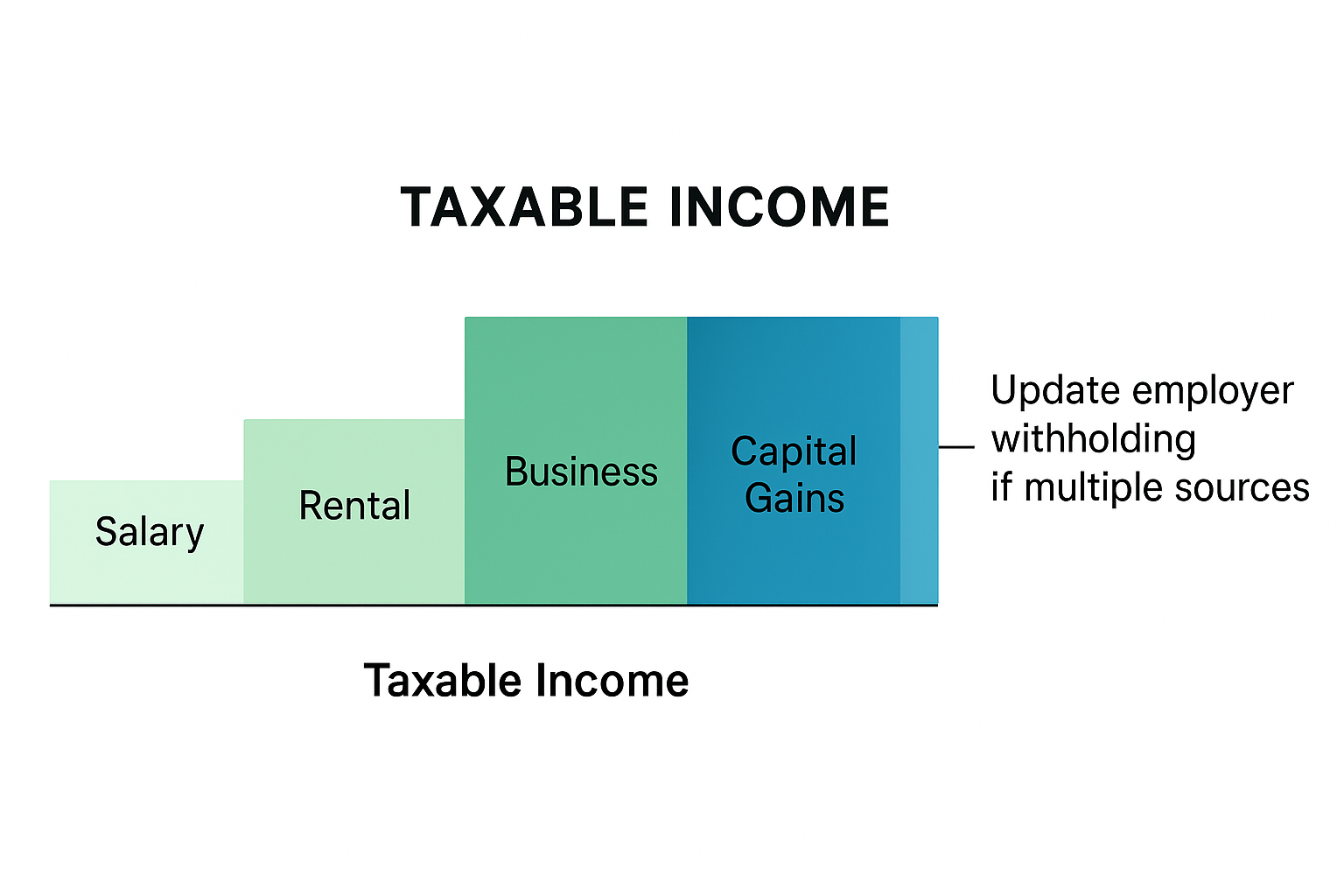

Q3: What happens if I have multiple income sources? All income sources are combined to determine your total taxable income. Ensure all employers are aware of your other income sources for proper tax deduction.

Q4: Are there any new exemptions for 2025-26? The basic exemption remains Rs. 600,000. However, certain deduction limits have been increased. Check the latest FBR circulars for sector-specific updates.

Q5: How reliable are online tax calculators? They're excellent for estimates, but always verify with official FBR tools or consult a tax professional for complex situations involving multiple income sources or unusual deductions.

Calculation-Specific Questions

Q6: Why is my monthly deduction different from online calculators? Monthly deductions may vary due to timing of bonuses, varying monthly salaries, or different deduction applications. Annual reconciliation typically resolves these differences.

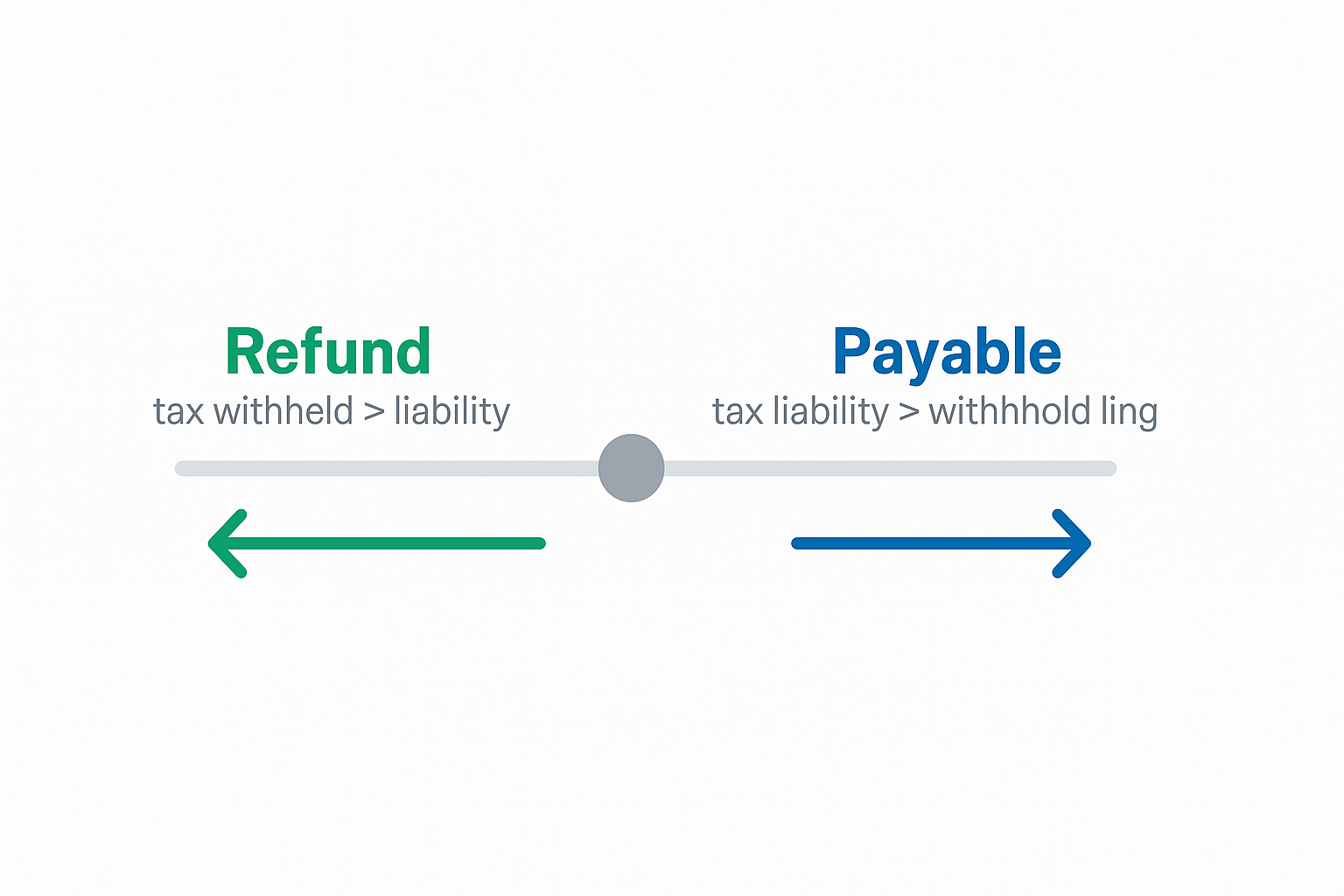

Q7: Can I get a refund if too much tax was deducted? Yes, if your annual tax liability is less than the amount deducted, you can claim a refund when filing your annual return.

Q8: How are bonuses taxed differently? Bonuses are added to your regular income and taxed according to your overall annual income bracket. They may push you into higher tax brackets.

Filing and Compliance Questions

Q9: What if I miss the filing deadline? Late filing penalties apply, but you should still file as soon as possible. Penalties vary based on how late the filing is and your income level.

Q10: Do I need to file if my employer already deducted taxes? If you have only one income source and no additional deductions to claim, filing may not be mandatory. However, filing ensures you claim all eligible deductions and refunds.

Q11: How long should I keep tax-related documents? Maintain all tax documents for at least 5 years from the filing date, as FBR can request verification within this period.

Q12: Can I file taxes for previous years? Yes, you can file belated returns for previous years, though penalties may apply. It's better to file late than never.

Deduction and Planning Questions

Q13: What's the maximum I can save through tax planning? This depends on your income level and eligible deductions. Higher earners typically have more opportunities for tax savings through strategic planning.

Q14: Can I claim medical expenses for my parents? Yes, if they're dependents and you're financially supporting them. Ensure you have proper documentation and they meet dependency criteria.

Q15: Are there any tax benefits for first-time home buyers? Yes, specific benefits exist for first-time home buyers, including deductions for mortgage interest and property purchase incentives.

Digital and Technical Questions

Q16: Is the FBR e-filing system secure? Yes, the FBR e-filing system uses bank-level security protocols. Always use the official portal and never share login credentials.

Q17: Can I modify my return after filing? Yes, you can file amended returns within specified timeframes if you discover errors or omissions in your original filing.

Q18: What if I face technical issues while e-filing? FBR provides technical support through their helpline and regional tax offices. Document any technical issues for penalty waiver requests if needed.

Professional Consultation and Additional Resources

When to Consult a Tax Professional:

- Multiple income sources from different sectors

- International income or foreign assets

- Complex investment portfolios

- Business ownership or partnership income

- Significant changes in financial situation

Official Resources:

- FBR Main Website: https://www.fbr.gov.pk

- FBR E-Filing Portal: https://e.fbr.gov.pk

- FBR Helpline: 111-772-772

- IRIS System: Official integrated revenue system

Regional Tax Offices:

Contact your regional FBR office for personalized assistance and clarification on complex tax matters.

Conclusion and Key Takeaways

Navigating Pakistan's 2025-26 tax system requires understanding the progressive structure, staying updated with current rates, and implementing strategic tax planning. Key points to remember:

- Progressive System: Higher earners pay higher rates only on income above each threshold

- Current Rates: Verify all calculations against official 2025-26 tax slabs

- Strategic Planning: Maximize legitimate deductions to optimize tax liability

- Compliance First: Always prioritize proper filing and documentation

- Professional Help: Consult experts for complex situations

The tax landscape continues evolving, and staying informed through official FBR channels ensures compliance and optimal tax management. Regular reviews of your tax strategy, especially during significant life changes or income fluctuations, help maintain efficiency and compliance.

For the most current information and official clarifications, always reference the FBR's official website and consult certified tax professionals when needed.

This guide is updated regularly to reflect current tax laws and regulations. For the latest information, visit the official FBR website.Disclaimer: This information is for educational purposes. Always consult official FBR sources and qualified tax professionals for specific tax advice and final calculations.